Note: GJEL Accident Attorneys regularly sponsors coverage on Streetsblog San Francisco and Streetsblog California. Unless noted in the story, GJEL Accident Attorneys is not consulted for the content or editorial direction of the sponsored content.

On the November 2022 ballot, voters in many local counties and cities will decide whether to tax themselves to pay for things like city services, school infrastructure, fire and emergency services - and road repair and maintenance. More than twenty ballots float some kind of hotel tax increase, for example. These might feel like a safe bet, since imposing taxes on outsiders is probably easier than getting people to agree to tax themselves. But is anyone asking who is using the local hotels?

Marijuana taxes are also on seventeen local ballots, with cities still trying to decide whether to allow cannabis businesses. Manhattan Beach, for example, has competing ballot initiatives about the local ban on marijuana businesses.

But Streetsblog is here to talk about tax measures to pay for transportation. As California state programs move (glacially) away from funding highway expansions, for great reasons, local governments are not very willing to change their highway building ways - and sales taxes can shore up those outdated ways. This has a lot of consequences: for one, using sales taxes for highways means everyone who buys stuff pays for highways, whether they drive on them or not. For two, many local tax initiatives include specific projects, submitted to voters to approve or disapprove as a list. These lists are formulated for maximum vote-getting - one for you, one for me - and not always in response to a region's goals, be they climate or clean air or even mobility goals.

Also, by voting to tax themselves, a county becomes a "self-help" county, eligible (and/or more competitive) for state and federal matching funding.

But local and regional sales tax measures for transportation are not easy to pass. Even with majority support, many measures have failed to reach the two-thirds vote threshold required. To get them across the finish line, a list of projects that pleases the most and displeases the least must be agreed upon; coalitions must be built among disparate groups - bike advocates and labor, for example; and get-out-the-vote efforts must keep at it until election day.

Or, if you're sneaky, you can try what the Committee for a Better Sacramento did this year: write your own list of projects and get the developers and construction unions who think they will benefit to bankroll a signature gathering campaign. That worked because a "citizen's initiative," even if it is a tax measure, only needs fifty percent (plus one) to pass, rather than 66.67 percent. And the only definition of "citizen's initiative" is that someone gathered signatures for it.

Sacramento's Measure A, the "Roads and Air Quality Sales Tax Initiative," is a half-cent sales tax its backers say will "improve roads and air quality," but which the Sacramento Council of Governments says will dramatically increase air pollution, violate state climate laws, and jeopardize the region's ability to access other state and federal funding.

One of the biggest projects on that initiative's list is the Southeast Connector project, a planned new freeway that proponents have pushed for years. Submitting the project for state funding, planners knew it would induce driving and increase vehicle miles traveled (VMT), but they found a twisted way to word that as a win. That is, knowing that the state is concerned about reducing VMT because of the climate impacts from transportation, they have claimed in their project descriptions that the new freeway would "reduce congested VMT." Not VMT, of course - that would have been provably false. Someone thought this sounded better.

More on Measure A at the Sacramento Bee.

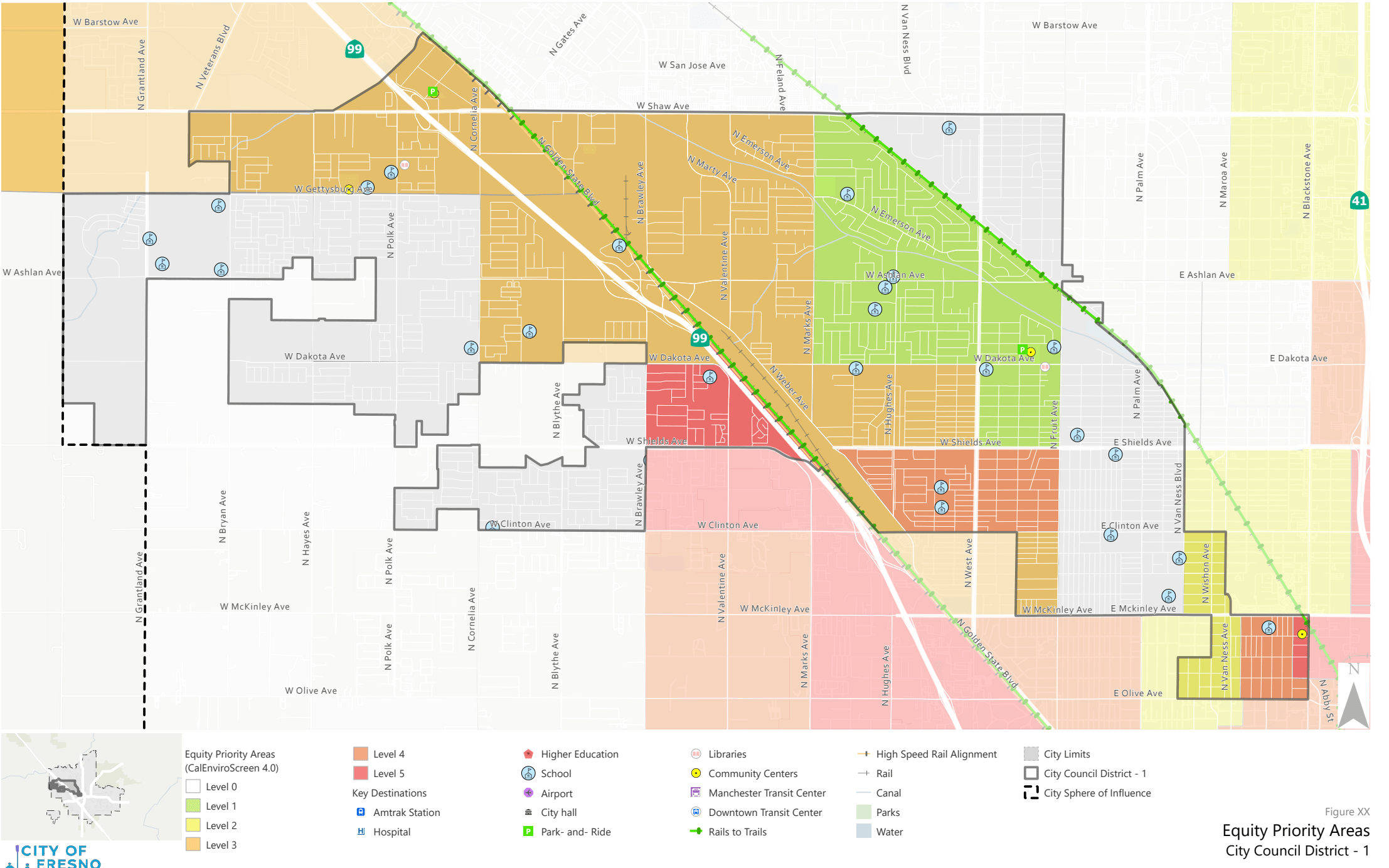

Another not-so-great measure is being floated in Fresno County, where Measure C seeks to renew the county's half-cent transportation tax five years before it is set to expire. The measure, put on the ballot by the Fresno Council of Governments, drastically changes the shares of funding going to roads vs. transit, cutting transit funds by almost forty percent. The City of Fresno objected vehemently to this change, as it would cause deep cuts in transit service. Fresno COG claimed that area residents want the money to be spent on fixing highways.

That measure does need a two-thirds vote, so November will tell.

Nearby Madera County is also weighing an extension on an existing half-cent transportation tax. That tax, Measure T, is set to expire in 2027, and the current ballot measure would extend it indefinitely.

Renewing Measure T would put 62.5 percent of the funding raised towards community and neighborhood streets and roads, including pothole repair and repaving, and "eliminating bottlenecks ... caused by inconsistent growth patterns, additional lanes, bridge improvements, and operational improvements." 25 percent would go towards major county routes and arterials, including highway interchanges. Four percent would go to transit services, and four percent would be set aside for Safe Routes to Schools improvements.

In San Francisco, voters will weigh in on whether to extend the current transportation sales tax for another thirty years, and whether the transportation authority should be authorized to issue bonds against future sales tax revenue.

Measure L would not change the spending plan, which currently supports transit and pedestrian projects as well as "congestion reduction."

And also in San Francisco, competing measures ask voters to weigh in on whether to keep private vehicles off the JFK Promenade in Golden Gate Park. Proposition I, put on the ballot by the De Young Museum, would allow them on the road most of the time (no), and Proposition J (yes) would keep it open to and safe for bike riders, skaters, walkers, kids, pets, and everyone else not in a car.

Outside of the San Francisco measures, most of these tax proposals would just extend an unsustainable, unhealthy, climate-damaging status quo.