Note: GJEL Accident Attorneys regularly sponsors coverage on Streetsblog San Francisco and Streetsblog California. Unless noted in the story, GJEL Accident Attorneys is not consulted for the content or editorial direction of the sponsored content.

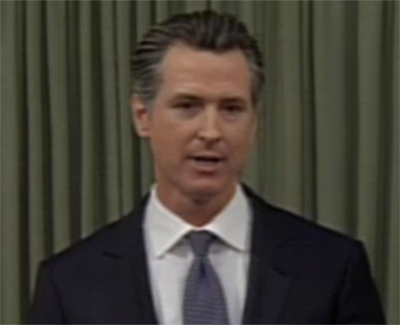

Today California Governor Gavin Newsom announced a package of bills and budget proposals [PDF] aimed at supporting cities to plan and zone for new housing. Hidden in its fine print is the opening to a discussion about how transportation funding could be withheld from cities that do not build enough housing.

When he first hinted at this idea in his state budget speech in January, Newsom did not offer details. There is a huge need for more housing, and cities are not building it and in some cases actively blocking it because they don't want to add density. At the same time, the newly reliable gas tax is a source of funding cities count on, and Newsom hinted that withholding that money could be a way to force cities to build needed housing.

It's not far-fetched to connect transportation money and housing. The location of housing dictates some of the need for transportation infrastructure, but planning and funding in California usually works the other way around. That is, regions plan transportation based on where people are trying to get to, which stems from where they live, where they work, and where services are--which is determined in a usually project-specific planning process.

Efforts to require cities to build more housing, especially where new residents would have access to transit and other alternatives to driving, have had limited success.

But legislators have balked at using the gas tax as a cudgel. Passing S.B. 1 was a hard-won victory, made even more precious by the (failed) attempt to repeal it by popular vote. They were so worried about the outcome of the S.B. 1 vote that they agreed to put a referendum on the ballot requiring gas tax money be used for transportation purposes only.

Newsom is not proposing to shift S.B. 1 money to something else, but rather to use it as a threat. "S.B. 1 Local Streets and Roads funds may be withheld from any jurisdiction that does not have a compliant housing element and has not zoned and entitled for its updated annual housing goals," starting in 2023, says the proposal.

In a press release announcing it, Newsom wrote: “Our state’s affordability crisis is undermining the California Dream and the foundations of our economic well-being. Families should be able to live near where they work. They shouldn’t live in constant fear of eviction or spend their whole paycheck to keep a roof overhead. That’s increasingly the case throughout California.”

Newsom's proposal is much bigger than just this one idea. He would change the way the state sets its regional housing goals, and provide money to encourage cities and counties to plan and zone for higher housing targets. Other parts of his overall housing package include tax credits and loans to help make sure the housing that is planned gets built.

Legislators and advocates have been saying for a while that the Regional Housing Needs Assessments, as currently conducted, are too low, in addition to being largely unenforceable. Newsom's proposal would set higher short-term statewide housing goals than the current RHNA process sets, and distribute those goals among regions based in part on the distribution of jobs, number of households, and share of low-income housing.

A process would also be set up with the Office of Planning and Research, the California State Transportation Agency, and Department of Housing and Community Development (HCD) to find a better way to set long-term regional housing needs. And money would be made available to support planning for housing, including finding ways for local or regional policies to link transportation funds to housing outcomes.

That would give cities and regions a say in how this notion of using gas tax money works out on the ground.

Newsom proposes to distribute $250 million to cities to plan for more housing, and to offer another $500 million as incentives or rewards if they actually meet production goals. The regions, working with the HCD, would determine how to set those incentives.

A separate bill would add $500 million to the housing tax credits program and another $500 million for loans to encourage housing production.