Note: GJEL Accident Attorneys regularly sponsors coverage on Streetsblog San Francisco and Streetsblog California. Unless noted in the story, GJEL Accident Attorneys is not consulted for the content or editorial direction of the sponsored content.

Proponents of Prop 6, which would repeal the recently passed gas tax increase, S.B. 1, want people to support their proposition, of course. They've put together a handy list of six reasons to vote yes on the S.B. 1 repeal—and Carl DeMaio, the failed candidate for San Diego Mayor turned radio personality who authored the proposition—has provided even more.

As he tours California to convince voters of the proposition's righteousness, it's worth taking a hard look at those reasons, because some people seem genuinely confused.

We could start with DeMaio's assertion that taxation is equivalent to terrorism. To be specific, he accused opponents of Prop 6 of terrorism (for, hmmm, scaring people?) because they pointed out that California will lose billions in transportation funding if the tax is repealed.

When did "telling the truth" become terrorism?

A local station in San Diego quotes him saying: “That's terrorism, that really is taking hostage the projects we've already paid for... The reality is not a single penny of the gas tax is actually earmarked for roads.”

Let's leave aside the overblown rhetoric for now and focus on what look like substantive claims.

First: Those projects he says are being "taken hostage" would, in fact, come to an end. Prop 6 would return California to its previous situation of having a gas tax that hadn't been raised in decades, was not indexed to inflation, and raised unstable, inadequate amounts of revenue. And saying they are “already paid for” is just blowing smoke. Gas tax revenues are an ongoing source of funding, and projects take years to plan and build. Many projects being worked on now, thanks to SB1, are still in the planning stages—and if Prop 6 passes, say bye-bye forever to them.

That's because Prop 6 would make it impossible to ever raise any gas tax in California. This is something that can't be emphasized enough: Prop 6 is a constitutional amendment that would require voter approval of any future increases in gas and car taxes. Given how difficult it was to pass S.B. 1 with a two-thirds vote of the legislature plus approval by the governor, the likelihood of fixing the old tax's shortcomings via a two-thirds vote of the public are very slim.

The Howard Jarvis anti-tax groups strongly favor Prop 6, and especially this part of it. That's not necessarily a recommendation. City, county, and school district budgets were slashed after their signature Prop 13 passed, and the extreme differences in property tax rates among neighbors--including industrial properties --is their legacy.

Before S.B. 1, cities and counties struggled to pay for basic road maintenance—witness the current mess on our streets, and the years of panicky complaints in the media about potholes. But they did find other ways to raise money, such as via sales taxes, which are more regressive and less directly connected to transportation than the gas tax.

If we can't increase the gas tax, is the state supposed to try raising money for roads via gambling--the way the creation of the California lottery was supposed to pay for schools?

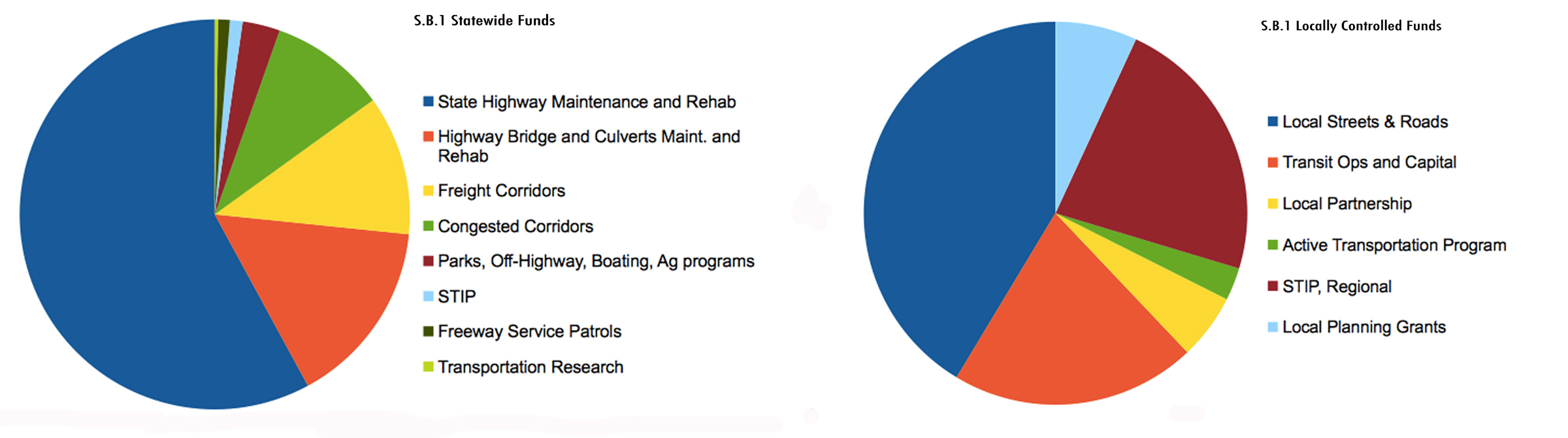

Second: “Not a single penny of the gas tax” is pretty hyperbolic, even for someone who loves being dramatic as much as DeMaio. Roads are being repaired all over the state right now with money that has already come in from S.B. 1. You can find them on this map. Transit projects and active transportation projects have gotten money too, although not nearly as much as projects that benefit drivers of private vehicles, which can be seen in the charts at the top.

Now for some of those other arguments in favor of Prop 6:

- “It costs you a lot!”

Depending how they do the math, Prop 6 proponents claim that the gas tax costs the average two-car-driving family either $779.28 or $1,500 a year. AAA estimates that badly maintained roads cost the nation's drivers $3 billion a year, which they average out to $300 per driver. TRIP, a national transportation research organization, puts that number much higher—at between $2,000 and $3,000 per driver annually in California, depending where you drive.

You can argue about the numbers, but don't pretend that road maintenance won't cost anything one way or the other. The question is, would you prefer paying for safer roads, or would you rather pay via unexpected repairs to your vehicle and emergency medical care? Preventative maintenance offers many more benefits than just a smooth ride, but it's been difficult to keep up with in California because funding tends to go towards new projects rather than maintenance on what we already have.

- “It’s a blank check without accountability”

S.B. 1 contains very specific language about what the money could be used for, and in the year plus since it passed, Caltrans and the California Transportation Commission have held numerous open, public workshops to discuss details about S.B. 1 program goals and priorities. Anyone can weigh in. Also, at the same time that S.B. 1 passed, the legislature put Prop 69 on the June ballot. That proposition required all funds raised by S.B. 1 to be used for transportation purposes only, and it passed with 81 percent of the public vote.

That's apparently not enough for DeMaio and his crowd. They are proposing a ballot proposition for next year that would prevent gas taxes from being used for anything except roads. That means “no staffing costs, it has to be actual concrete and asphalt!” according to their press materials. “Roads must be the only use for gas tax funds.”

It's hard to imagine how road repairs can be made without any planning, designing, or engineering input.

- “The gas tax keeps going up”

Well, yes. Building in regular increases in the gas tax is the only way to avoid the situation California was stuck in before S.B. 1 passed. Passing any increase with a two-thirds vote of the legislature plus support from the governor, which was required for S.B. 1, is a heavy lift, and building in regular increases is an important part of that bill.

- “The waste is staggering”

Prop 6 proponents are relying on a report from the Reason Foundation about Caltrans inefficiencies. The department maintains over 50,000 miles of state highways, which takes a lot of time, people, and money, which they don't always have. No one would claim that Caltrans is perfect, but relentlessly bashing them to gain political mileage is not constructive. It would be more useful if the bashers also took note that the state has been addressing some of the major problems with Caltrans over the last four years, and while progress is slow it hasn't been nonexistent.

- “Beware of deceptive promises”

Yes, indeed. “Politicians . . . are planting stories in the media touting the number of road projects they promise to do if you vote against the repeal,” the website continues. “Those projects 1) represent only a fraction of the gas tax hike 2) can be 100 percent funded by existing gas tax revenues and 3) are simply promises during a campaign that will likely be broken after election day.”

1) It is true that the projects so far "represent only a fraction of the gas tax." S.B. 1 is a ten-year program, and it takes many years for projects to be planned, approved, designed, and constructed. More projects, will be coming online in the next decade, if Prop 6 is defeated.

2) No: Existing gas tax revenues are not adequate. See above.

3) S.B. 1 clearly lays out what the money must be spent on; Prop 69 does not allow shifting of revenue.

DeMaio and company will harp on this “don't trust the government” theme endlessly, and a depressingly large number of people will accept it at face value. Sure, politicians can be slimy, and they can engage in horse-trading, and they can put up a front while doing underhanded things where it's harder to see them. But is the solution just throwing up our hands and giving up? Refusing to pay for anything?

And finally:

- "There’s a better way"

Prop 6 proponents plan to introduce yet another initiative to fix the mess they would create be repealing S.B. 1. This "better way" so far includes no money from the gas tax for anything but roads--including none for transit or "other transportation" or, for that matter, Caltrans engineering--some shifting around of vehicle sales tax revenues, "efficiency reforms" which are already part of S.B. 1, and--oh yes--ending the high-speed rail program.

Any "unspent funds" from high-speed rail would be shifted to "other transportation needs." That will make for some very interesting legal arguments. Most of the money for high-speed rail so far has come from a voter-approved bond--not shiftable--and cap-and-trade funding--revenue which cannot be used to make it easier to drive, so not for highways.

Californians demand a safe, convenient way to get where they need to go, and complain loudly if that system doesn't operate well for them. Do they really believe they can have it without helping pay for it?