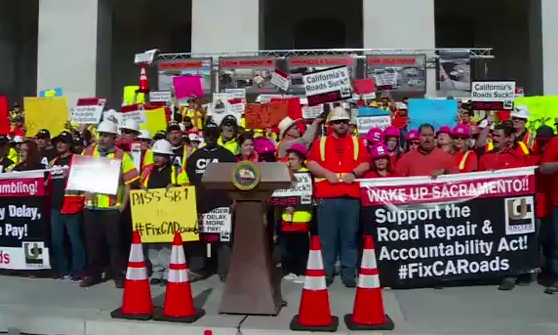

Today-- Thursday--the authors of S.B. 1 plan to present it for a vote on the floors of the Senate and Assembly, and things have been heating up around the subject in Sacramento. Leaders held a rally in front of the capitol steps calling for support, saying that “it's time to get it done!”

But leaders of the local air districts came out in strong opposition to the last-minute amendment, covered by Streetsblog, that would exempt the trucking industry from their oversight. They sent a strongly worded letter in opposition to the bill [PDF] and have been meeting with Senate and Assembly leaders in the lead-up to today's vote.

What's terrible and ironic is that in many ways, S.B. 1 is remarkably improved from the version that had been shopped around at the beginning of the session. It appropriately focuses on money—except for that trucking amendment, that is: on where it's coming from, what it's going to, and on how to manage and oversee that spending.

Gone are some of the bill's strange and unrelated provisions, including streamlining of environmental reviews for highway projects, removal of the California Transportation Commission from the California State Transportation Agency umbrella, and reliance on the unstable and unreliable cap-and-trade funds as the only source for public transportation money.

It even replaces the Traffic Congestion Relief Program—which focused on widening and expanding highways—with a new, more balanced program called “Solutions for Congested Corridors Program” to be designed “to achieve a balanced set of transportation, environmental, and community access improvements within highly congested travel corridors throughout the state.”

But that last-minute amendment hamstringing the regulation of emissions from trucks is a stinker, and it has put the bill's supporters in a tight spot. Because they want to get it passed tomorrow, they can't amend it further—exactly what the trucking industry, and whoever put this provision in the bill, is hoping for.

The amendment now reads that it “would prohibit. . . the requiring of the retirement, replacement, retrofit, or repower of a self-propelled commercial motor vehicle during a specified period,” and adds a caveat that the Air Resources Board should evaluate the impact of these provisions on “state and local clean air efforts to meet state and local clean air goals,” —by 2025.

The California Air Pollution Control Officers Association—which notably represents all of the air districts in the state, not just the ones that tend to be more environmentally activist—did not agree with Air Resources Board executive director Richard Corey's conclusion that this changed amendment would give them the flexibility they need to do their job. Instead, they wrote, it would:

- Impede or preclude an air district’s ability to adopt indirect source rules that may affect trucks, such as at ports, warehouses, railyards, and airports, and

- Limit ARB and air district authority to require retrofit control technology regardless of local benefits to public health or even in the case of affordable technological breakthroughs, and

- Prevent the South Coast Air Quality Management District from adopting fleet rules that would clean up state and local government fleets to zero and near zero emission levels as quickly as feasible.

The letter concludes, in bold face:

We strongly urge you to delete the trucking exemption, or to further amend Section 18 to make clear that the language does not, in any way, restrict ARB or air district authority.

Here's a quick rundown of what the bill contains:

MONEY WOULD COME FROM:

- A 12-cent-a-gallon increase on gas excise tax

- A 20-cent-a-gallon increase in diesel excise tax

- An increase in the Vehicle License Fee, ranging from $25 to $175 depending on the value of the vehicle

- A new annual $100 fee on electric vehicles starting in 2020

- An additional 4 percent increase in sales and use tax on diesel

It also would stabilize gas taxes by eliminating the annual “gas tax swap” readjustment, and index them to inflation so they don't have to be raised again in the future.

Note that raising the gas taxes would bring them more in line with the actual costs imposed on roads by vehicles than they have been for a long time, given rising fuel efficiency in cars and unchanged tax rates. The effect on gas prices would be nowhere near some of the spikes in price that consumers have swallowed in the last decade—and those benefited no one but the oil industry.

MONEY WOULD GO TO:

- $200m per year for road maintenance in “self-help” counties—those that have passed a local transportation tax or funding scheme—according to performance criteria

- $100m per year for the Active Transportation Program

- $400m per year for state highway bridge and culvert maintenance and rehabilitation

- $5m per year for workforce training

- $25m per year for freeway service patrols

- $25m per year for local planning grants$7m per year for transportation research at UC and CSU

- The remainder would be split in half between state highway system maintenance or operation and cities and counties by formula

- The additional 4 percent increase in sales and use tax on diesel would be for public transportation

- Half of the diesel excise tax increase would go to a new Trade Corridors Enhancement Fund

- Gas tax increases on boats and off-road vehicles would be used for Parks and Recreation Fund

OVERSIGHT AND OTHER PROVISIONS:

- Would create the Independent Office of Audits and Investigations within Caltrans, headed by an Inspector General

- Would require Caltrans to update the Highway Design Manual to incorporate “complete streets” concept

- Would require increasing contracts awarded to small, minority-owned, and disabled veteran-owned businessesWould accelerate repayment of transportation loans to general fund

- Would end the Traffic Congestion Relief Program and instead creates e the Solutions for Congested Corridors Program to achieve a balanced set of transportation, environmental, and community access improvements within highly congested travel corridors

- Would create an Advance Mitigation program to speed up CEQA issues and protect environmental resources

AND...

- Would prohibit requiring the retirement, replacement, retrofit, or repower of a self-propelled commercial motor vehicle