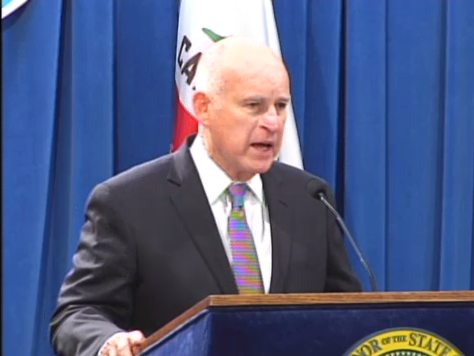

Governor Jerry Brown released his proposed 2018 budget this week, as usual warning about an inevitable downturn despite the current strong state economy and calling for fiscal prudence. Nevertheless, the transportation portion of the budget received a big boost from S.B. 1, the new gas tax that went into effect in November, including new vehicle license fees starting January 1.

Transform's Joshua Stark finds reason to like what's in the budget so far, in part because it would invest more in public transportation, walking, and biking than any previous state budget.

The gas tax is expected to raise over $4.6 billion in its first year for transportation projects, with over $800 million of that directly invested in transit and active transportation projects, according to Stark:

- $330 million for the Transit and Intercity Rail Capital Program (TIRCP)

- $355 million for the State Transit Assistance Program

- $100 million for the Active Transportation Program (to a total of around $220 million)

- $36 million for commuter rail and intercity rail

“In particular,” writes Stark, “the increase to the TIRCP results in dedicated investments for equity — a first for California’s traditional transportation funding programs.”

The TIRCP is a program funded by the Greenhouse Gas Reduction Fund (GGRF), which invests money from the cap-and-trade system in projects that reduce greenhouse gases, and it is required to invest at least a quarter of its revenues to benefit disadvantaged communities. By adding money from S.B. 1, writes Stark, “California is better aligning transportation funding with the urgent need to address climate change and inequality.”

Brown has not yet released his plan on how to spend the GGRF. Cap-and-trade spending has been treated as a separate process from the rest of the budget, and Brown plans to release his ideas for this year at his State of the State speech on January 25.

Meanwhile, Jared Sanchez of CalBike was cautiously optimistic, calling the budget proposal “a fiscal double-edged sword.”

“Increasing meaningful appropriations for sustainable modes of travel is no small feat,” he said. But much of the transportation funding in California remains unconnected to other state goals. “With no strong connection between transportation funding and social equity, climate change, or public health, any increase in the former remains feeble and inadequate,” said Sanchez.

Stark pointed out that there are several things missing from the proposal that TransForm argues need state attention, including “larger investments in the Active Transportation Program and dedicated funding for student transit passes.”

Budget negotiations will continue throughout the spring, and Brown is expected to issue a revised budget proposal in May, when it's a little more clear what tax revenues will likely be. The final budget must be approved by both the Senate and Assembly by the end of June.