In today's Ask the Editor podcast, Streetsblog contributors Damien Newton, Melanie Curry, Jason Islas, and Kristopher Fortin talk about some of the main stories Streetsblog California covered in 2016.

But we didn't get very far, because there are so many stories to talk about. Streetsblog California covers statewide issues, which tend to be policy-focused and wonky, but we also cover local stories that reflect the influence of those policies on the ground. Right now we have Kris Fortin covering Orange County, and Minerva Perez reports on local issues in the Central Valley. We'd like to be able to cover local stories all over the state, to help local advocacy efforts learn from each other, but we are limited in our capacity, both in time and peoplepower.

Which brings us to the reminder that these podcasts are also fundraisers. Please click here to donate to Streetsblog California to support unique coverage of the issues you care about.

Those issues include the gas tax bill, S.B. 1. In the podcast, we talk about how this long-overdue gas tax increase raises money for needed infrastructure maintenance. Over the last year we reported on how the bill got passed and what the final bill ended up including. We followed up with reporting on how state agencies in charge of transportation funding have been formulating guidelines to spend the money wisely and, we hope, not just on building new roads that will mean more needed maintenance in the future (and won't solve congestion). Here, we also touch on the effort to repeal the bill, which would be a giant step backwards.

See the S.B. 1 website, here, which is the state's first move towards advertising the benefits coming from the gas tax: “Your Tax Dollars At Work.”

We also talk about the Active Transportation Program, which got a shot in the arm from S.B. 1—doubling funding for the program over the next ten years—and which in turn is kind of a poster child for the state to show immediate results from S.B. 1. And that brings its own complications, including the possibility that not-so-great projects could get funding just because they do something for bikes or pedestrians, rather than create a true transformation in the way planning for active transportation happens.

As Melanie points out in the podcast, transformational change is a slow process, but in California, it is going in the right direction. Sometimes.

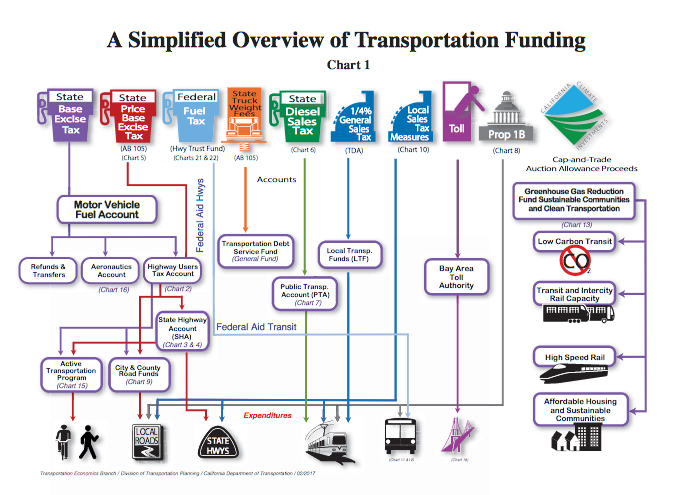

Finally, we attempt to answer one of the questions we got from readers in response to our previous podcasts. This question was related to S.B. 1. Getting Around Sac asked: how much of the state's road projects are paid for by state gas taxes? And the answer is: we don't know, and we're not sure anyone else has pinned down the answer. That's because the state's transportation funding system is complex beyond belief, even without the so-called gas tax swap that will eventually be repealed by S.B. 1.

Here's a link to some Caltrans charts that explain it in less than three hours.

But to the question: even with the new, higher taxes, state gas taxes probably don't cover a much larger portion of road charges than they did in 2015, when it was about 25 percent. In that year, more than half of all transportation spending was from local tax measures, many of which are sales taxes.

Which means, to answer an unstated but underlying question: no, roads are still not paid for mostly by gas taxes.

Here are some references for people who like to delve into the complexities of transportation funding. A Legislative Analyst Office report here describes S.B. 1 in some detail. And here's a report that takes apart the “user pays” myth of gas taxes.

And remember to donate to Streetsblog California so we can continue to study and write about these issues and future ones, statewide and local.