The California Air Resources Board (ARB) will postpone its decision on strategies to meet 2030 greenhouse gas reduction targets until June to give staff more time to analyze alternatives and to allow more discussion.

Board chair Mary Nichols announced the move at the board's meeting in Sacramento today, which was the second in a series of three public discussions of the scoping plan. Additional workshops on aspects of the plan are also scheduled in the next few months.

In January, ARB staff presented a draft scoping plan to the board that included a few alternative strategies but focused its analysis on cap-and-trade. Members of the ARB's Environmental Justice Advisory Committee had been opposing cap-and-trade, which caps greenhouse gas emissions but allows industries to buy and sell allowances, including offset allowances outside of California. EJAC members and other environmental advocates based their objections on a report that showed that large emitters subject to cap-and-trade have not reduced local emissions and in some cases have actually increased emissions. Those industries also tend to be located in low-income communities and communities of color, rarely in or near predominantly white or privileged areas.

In response, ARB staff spent time analyzing a new alternative, which they're calling “cap and tax.” The strategy would place a cap on emissions that would decline each year, like cap-and-trade, and would tax all emissions at “the social cost of carbon” as set by the EPA, or $50 per ton in 2030.

Notably, under current auctions, cap-and-trade allowances cost around $11 to $12 per ton.

Under a “cap-and-tax” system, the main driver of emissions reductions would be the declining cap, not the tax, said staff. The tax would, however, be a source of revenue.

Staff said that their preliminary analysis showed the alternative cap-and-tax program would have a higher economic cost to the state than the current cap-and-trade system, and could result in a loss of jobs. Still to be determined, they said, are potential effects on economic growth, including discouraging industry from coming to California, as well as a decision about which year would be the base year from which the cap would decline. It is important, they said, not to create a situation where emitters try to game the system by increasing GHG emissions so as to have an easier reduction target.

Reactions to the proposal were passionate. Employees of the oil industry spoke of their families and their long-time connections to their jobs, and argued that replacing cap-and-trade with a carbon tax would destroy their livelihoods. A lobbyist from the Western States Petroleum Association cautioned board members to think carefully about the displacement that could happen if the oil industry lost jobs, and reminded them that “there is another way” to solve climate change—that is, the existing cap-and-trade system.

One commenter accused ARB staff of having a strong bias toward keeping cap-and-trade, calling the cap-and-tax alternative they presented a “straw man” that could easily be shot down. So far, he says, their analysis shows only strong negative economic effects, but it doesn't take into account other aspects of a direct carbon fee, such as its transparency and its reliability, which the current cap-and-trade auctions have not been able to produce.

Others reminded staff that job growth is also likely to take place, as “green sector” jobs replace oil industry jobs.

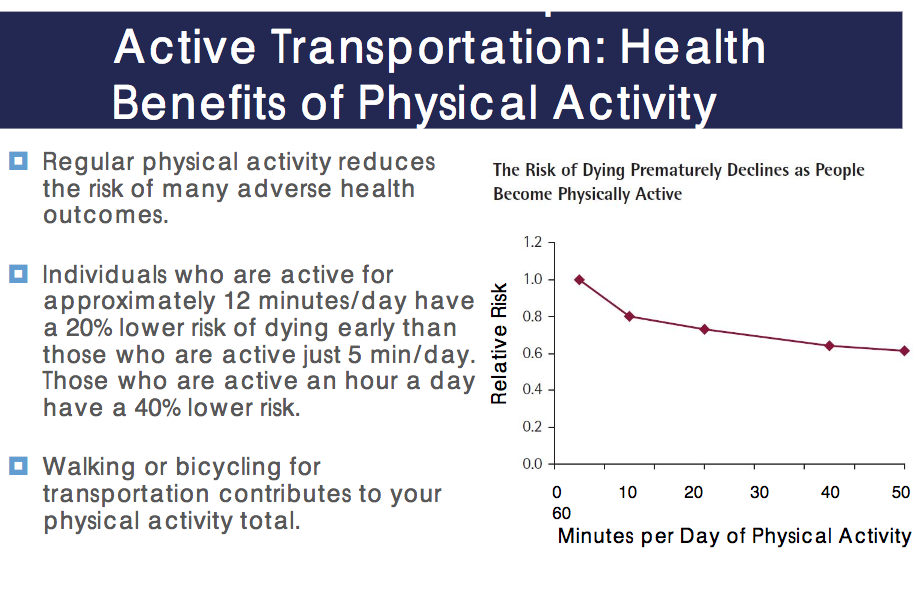

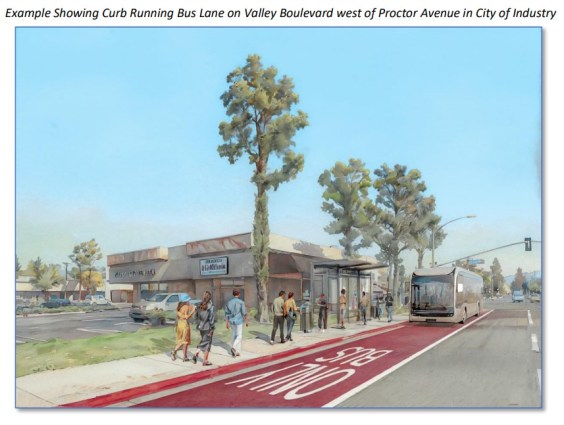

Staff were also urged to look at health impacts not only from emissions changes but from increasing active transportation as a way of reducing emissions. In addition, health impacts should be included in the economic analysis, not just relegated to a separate report.

Staff said they will continue refining the models they are using to analyze the alternatives, and the assumptions they use for those models, relying on input from stakeholders at ongoing workshops. The schedule of those workshops is in flux, given Chair Nichols' announcement, but information can be found here.