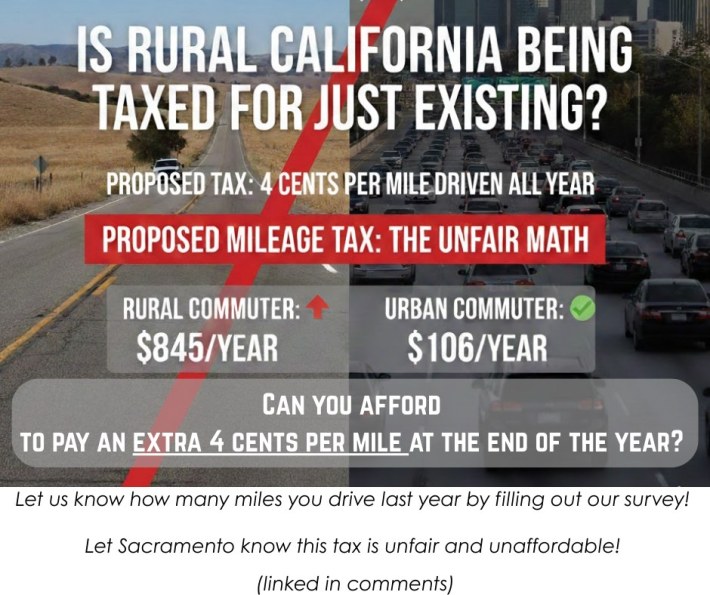

In early 2026, California’s plan to explore replacing its long-standing gas tax with a vehicle miles traveled (VMT) fee ignited a firestorm of public debate and online outrage. Headlines and social media feeds on the conservative right lit up with claims that the state was on the verge of imposing a new “mileage tax” that would charge drivers per mile driven — sparking fears of higher costs for commuters and grumbling about government overreach.

Yet beneath the buzz and the partisan rhetoric lies a more precise reality: the legislation that prompted this uproar — Assembly Bill 1421 — does not immediately create or implement a new tax. Instead, the bill, which the California Assembly passed on January 29, 2026, directs the California Transportation Commission to continue and deepen a study into whether a road usage charge could eventually serve as an alternative to the state’s traditional gas tax.

The bill's author, Assemblymember Lori Wilson (D-Suisun City) has repeatedly tried to put down concerns about the legislation. She told the Sacramento Observer last week that, "“We’ve been studying alternatives to the gas tax since 2014. What this bill does is bring together all the work that’s already been done — by universities, state agencies, and pilot programs — and ask for a complete report back to the Legislature.”

California's Transportation Funding Is in Crisis

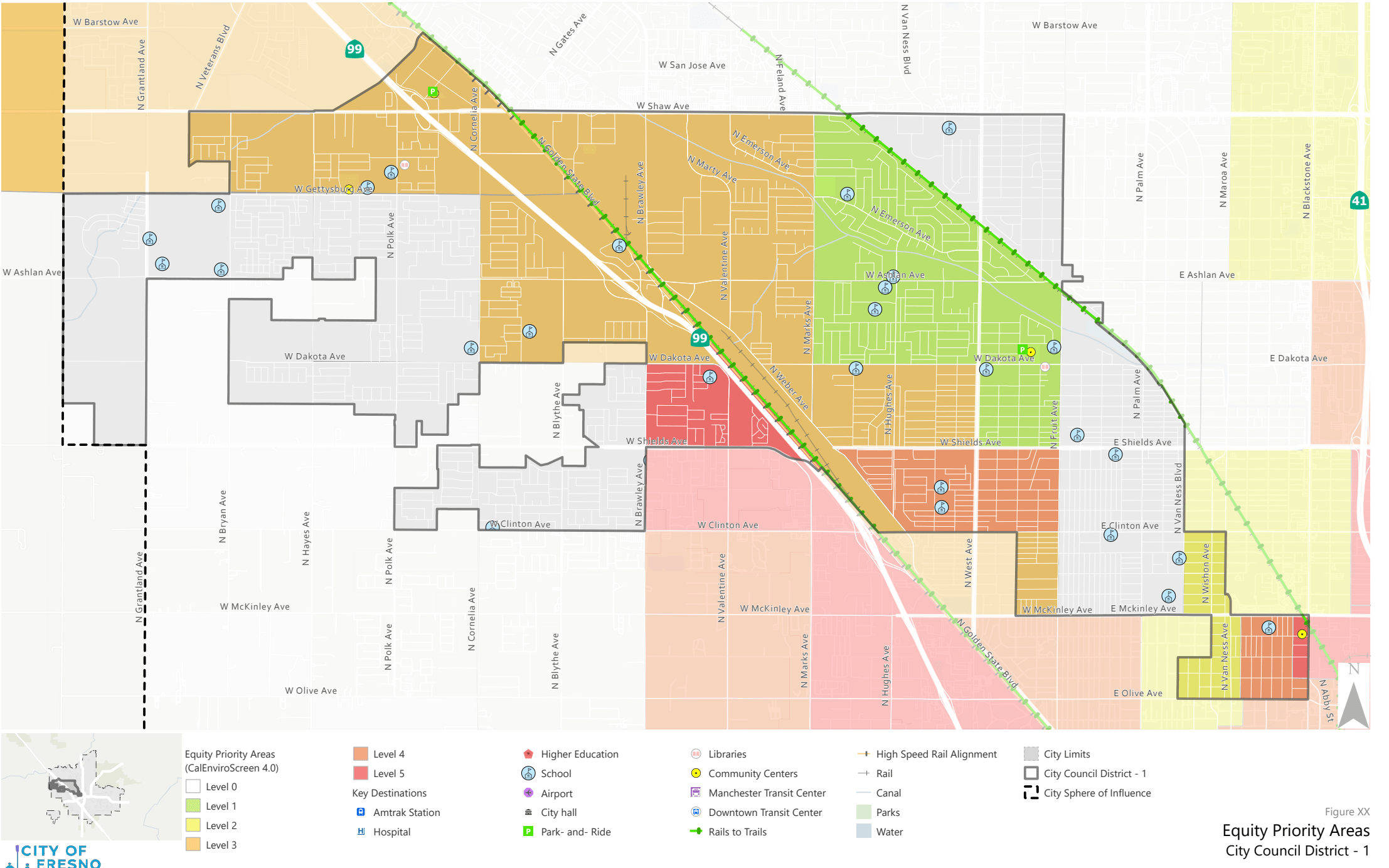

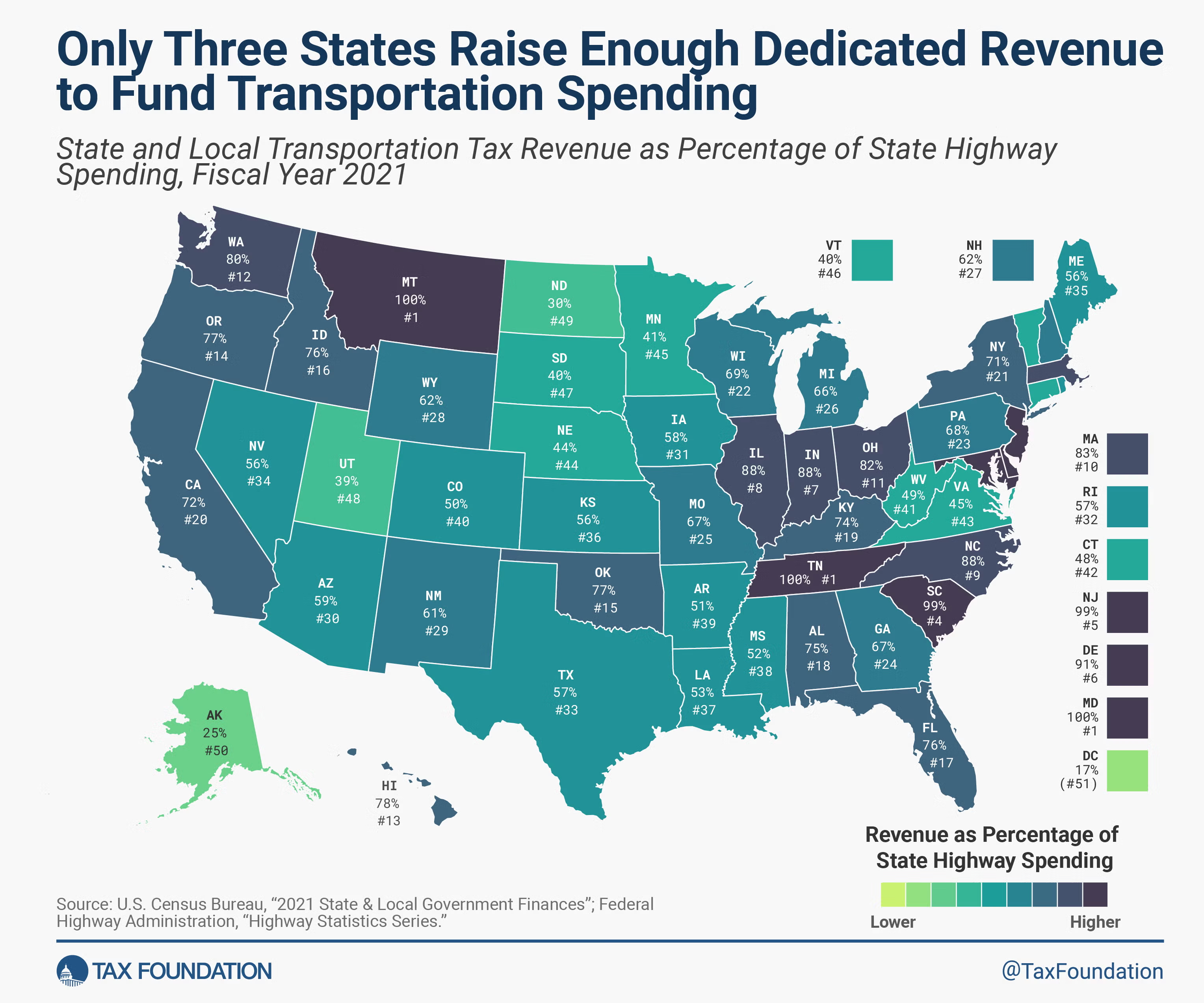

California faces a roughly $215 billion, 10-year transportation funding gap ($756.8 billion in needs vs. $541 billion in projected revenue). The 2025-26 budget reduces transportation spending by 13% ($4.5 billion) due to declining one-time funds, while the Motor Vehicle Account (MVA) faces insolvency by 2025-26 without transfers.

California’s transportation funding system has long relied on the state gas tax — a per-gallon fee drivers pay at the pump that is earmarked primarily to maintain roads, bridges and transit systems. But that model, which worked well for decades, is now under strain. As more Californians switch to hybrid and electric vehicles, gas consumption has dropped significantly. Gas tax revenue is shrinking even as the cost of infrastructure repair and expansion continues to rise. Experts warn this funding shortfall could grow by tens of billions of dollars over the next decade if policymakers don’t identify new revenue sources.

First hybrid cars and now electric vehicles present a particular challenge: they use the same roads as gas-powered cars but contribute little (or nothing) to the gas tax that pays for road maintenance. In some cases EV owners pay higher registration fees, but those offsets don’t fully make up for the loss of gas tax revenue.

Under the current system where most funds come from the gas tax, drivers of petroleum-powered vehicles can pay between $300 and $600 a year in gas taxes, while many electric vehicle owners pay as little as $117 annually through registration fees. And while the state wants to encourage the transition to electric vehicles, that is a massive gap, and a major reason that the gas tax needs to be replaced.

Transportation planners and economists have argued for years that a vehicle miles traveled (VMT) charge (also sometimes termed a "road charge" or "mileage based user fee" MBUF) — a fee based on how many miles a vehicle is driven — could be a more equitable way to fund transportation infrastructure and ensure all drivers pay in proportion to their road use.

The state created the Transit Transformation Task Force to rethink how public transit is funded, governed, and coordinated. The TTF wrapped up its two-year effort with a final meeting that many members found disappointing and limited in impact. While the panel did adopt last-minute motions urging the Legislature to identify new statewide funding sources for transit and to allow local ballot measures for transit revenue without prior legislative approval, it failed to advance stronger proposals and reforms because no staff-prepared recommendations were ready and procedural rules prevented votes before time ran out.

Task Force members and advocates described the final recommendations more as a starting point for future work than a finished reform package. The report required by AB 1421 would be the next step.

Instead of Discussion, Misinformation

Perhaps it's a coincidence, but at a time when the national Republican party has become a lodestone to the CA Republican party due to the ongoing federal invasion of cities, state Republican leaders decided to demagogue the issue of a VMT tax.

In the days after the Assembly passed AB 1421, snippets of the bill — stripped of context — began circulating online. “Mileage tax.” “Per-mile fees.” “Tracking drivers.” For many readers, that was all they saw before the conclusion snapped into place: Sacramento was coming for their odometers.

By the time economists and transportation officials tried to explain that California had been studying road usage charges for years — across multiple administrations and with bipartisan participation — the explanation rang hollow to critics. To them, “it’s just a study” sounded less like clarification and more like a stall tactic. In the logic of conspiracy thinking, denials don’t defuse suspicion; they deepen it.

The Carmichael Times blared, "Assembly Democrats Refuse to Stop a Double Tax on Drivers," a word-for-word reprint of a Republican press release. However, the VMT tax would replace - not stack with - a gas tax, so the headline was completely wrong. But they're hardly alone in printing this misinformation, it is repeated in "Help Stop the Proposed CA Tax on Driving," a unique news article by alleged newspaper the California Globe.

Hypothetical scenarios hardened into certainty, and projected numbers were repeated until they felt official. None of this required secret meetings or hidden language in the bill. It only required repetition — and the willingness to treat hypotheticals as settled fact.

But to dispel a misinformation campaign it will take more than mainstream press correcting the record or "community notes" on misleading social media. Yesterday, the Orange County Record published an op/ed by Sal Rodriguez, who spent his weekend fretting that there weren't enough rich white men running for Mayor of L.A., chiding Republicans for their fear mongering.

In "California Republicans tilt at windmills over nonexistent mileage tax," Rodriguez wrote, "There are plenty of legitimate criticisms to be made of the supermajority and state government. Instead, California Republicans have chosen to hyperventilate over an invented issue rather than acting as serious critics. It’s no wonder they’re in the superminority."

Maybe the message will resonate more coming from someone known to be right-of-center in California.