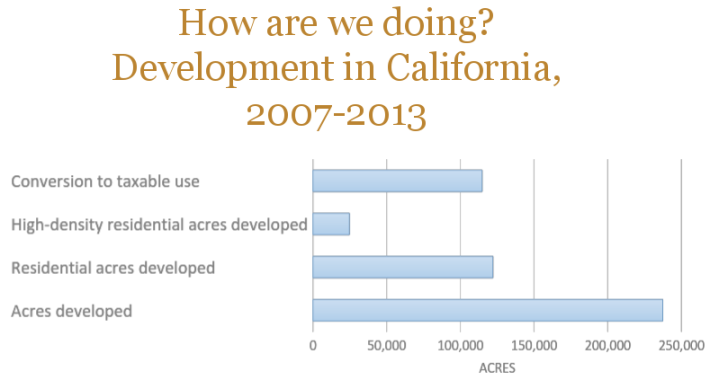

California's tax policies are at odds with its climate change policies, said UC Berkeley Professor Karen Chapple in a talk yesterday at the University of California Center in Sacramento. The current tax structure encourages big-box development and sprawl, she said, while making it difficult to build infill and high-density developments that could reduce auto dependence and greenhouse gas emissions from transportation.

Local jurisdictions rely on a variety of taxes for revenue, including property, sales, and income taxes. Property taxes are used for school districts and other expenses that are outside of local control. In contrast, sales taxes are kept locally, which has led to many cities finding it lucrative to encourage retail development that produces sales tax revenue.

This has led to some perverse outcomes, like cities offering large retailers tax breaks to encourage them to locate within their borders, thus reducing the amount of sales tax revenue gained. It also leads to situations where people drive across city borders to shop at retail stores where the taxes they pay won't benefit the city they live in.

While stopping short of suggesting specific tax reform measures, Chapple offered several principles to guide future tax reform from a perspective of making the tax system more consistent with climate change policies.

For example, she suggested sharing sales and property taxes regionally. For one thing, this would remove the incentive for cities to encourage large retail developments and discourage housing. And, she said, if sales taxes were allocated on a per-capita basis, jurisdictions would be encouraged to build more housing and to meet their Regional Housing Needs Assessment targets—targets set out in regional planning documents but resisted by many municipalities.

She also suggested the state find a way to return more property taxes to municipalities, to give them an incentive to build more housing, which might then lead to more balanced development. She acknowledged that this would be complicated, however, and that past attempts to do so have not been successful.

More directly, the whole tax system should be linked to environmental and sustainability goals, said Chapple. That would mean the gas tax, for starters, which theoretically could be a way to link behavior with outcome: if you drive more, and pollute more, you pay more (but which currently does not work quite so simply). A VMT or a carbon tax would be even more direct, and an oil extraction tax (“California is one of very few states that does not have one,” she said) could have similar effects on consumption.

Professor Chapple also suggested finding a way to better use cap-and-trade revenues to subsidize new housing development. Cap-and-trade does currently fund the Affordable Housing and Sustainable Communities program, but on a painstaking, project-by-project basis. Chapple suggested considering allocating money to municipalities that agree to help finance local infill.

And, she said, the state should put some funding behind S.B. 375, which requires regions to create a Sustainable Communities Strategy (SCS) tying together land use and transportation planning. Although every region now has an SCS that includes infill targets and discussions of jobs/housing balance, without funding, S.B. 375 can offer little in the way of incentives or enforcement to make sure the strategies are fulfilled.

In her talk, and in the research conducted for the lecture she delivered yesterday, Chapple touched on what she called “the elephant in the room,” Prop 13, but noted that it's a whole separate topic. This '70s tax reform law has made California property tax unique among the states. One of its many effects is on household mobility, as it tends to keep homeowners in existing housing to avoid new, and higher, taxes. This contributes to a jobs-housing mismatch as people are reluctant to move closer to jobs or may find they cannot afford to move.

A panel discussion after Chapple's talk included comments from Mac Taylor of the Legislative Analyst's Office, who pointed out that changing the tax code can have many unintended consequences. The net effect of a VMT tax, he said, is unclear. People could find that, if everyone pays a tax based on how many miles they drive, they are less inclined to choose zero emission vehicles.

Chapple agreed that any tax policy would have to be carefully thought out. “We don't want tax policies to get in the way of climate change policies,” she said, “or we'd be shooting ourselves in the foot.”

Katie Kolitsos of the Assembly Speaker's Office pointed out that there are a other factors, outside of tax policy, that contribute to reluctance to build housing and infill, including the fact that it is easier and cheaper to build in new areas than in older, built-up areas. Also, she said, there is a huge need to fund planning. Many local governments don't update their General Plans because they don't have the money or the capacity to do so. That means that the Sustainable Communities Strategies don't get incorporated into General Plans, and many municipalities approve plans that are based on outdated standards—like parking minimums, for example—that don't further climate change goals.

Chapple's talk was part of a series at the University of California Center in Sacramento that aims to bring UC researchers and legislators together to discuss data-based solutions to problems in California. It remains to be seen whether any legislators will pick up on any of Chapple's suggestions.

“California has shown that its legislators are not shy about passing bold climate change legislation,” said Chapple. “We should not hesitate to experiment with sensible tax code reforms that support our climate goals as well.”

More information about Chapple's research can be found at the University of California Center Sacramento website, where a policy brief and the white paper can be downloaded, and in this op-ed in the Sacramento Bee.